Woe To Walevi As They Will Be Required To Pay More Due To Import Tax Increament

After a freshly increased tax charge went into effect on Friday, the cost of your well-liked alcohol that is imported into the East African region is expected to increase significantly. This comes after the East African Community (EAC) partner nations implemented the Common External Tariff for imports entering the federation.

As part of a plan to promote domestic production and industrialization, a 35% fee will be applied to imported completed goods from non-member nations. As a result, the cost of importing the goods into Burundi, Kenya, Rwanda, South Sudan, Uganda, Tanzania, and the DR Congo has increased.

Alcohol, meat, cereals, cotton, and textiles are some of these commodities.

Importers have been informed of the changes and asked to take them into account in their tax transactions by the Kenya Revenue Authority (KRA).

According to a circular from the Kenya Revenue Authority, “customs and border control commissioner Lilian Nyawanda would like to draw the attention of taxpayers and the general public to recent changes in the Harmonized Commodity Description and Coding System (HS) and the East African Community Common External Tariff.

The new tax is greater than the 30 or 33 percent tariff that partner states had previously suggested. The decision ends the EAC Common External Tariff’s implementation, which started in 2005 once the EAC Customs Union Protocol went into effect.

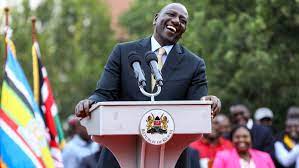

The Road to Victory: President Ruto’s Triumph in the August 2022 General Election

The Road to Victory: President Ruto’s Triumph in the August 2022 General Election  Finance Bill 2023- The Benefits

Finance Bill 2023- The Benefits  How Small Businesses Can Use AI to Increase Sales In Kenya

How Small Businesses Can Use AI to Increase Sales In Kenya  Not Today; Matiang’i’s Lawyer Says His Client Will Not Appear Before DCI Today

Not Today; Matiang’i’s Lawyer Says His Client Will Not Appear Before DCI Today  Senator Onyonka Urges President Ruto To Be Careful On How He Handles Matiang’i’s Case

Senator Onyonka Urges President Ruto To Be Careful On How He Handles Matiang’i’s Case  Form One Student Beaten To Death By Teachers Over Alleged Physics Exam Cheating

Form One Student Beaten To Death By Teachers Over Alleged Physics Exam Cheating